The banking and money systems in the US and throughout the industrialized world are structured in a way that mandates perpetual debt (see How the Debt-Based Economy Works (and doesn’t work). Because of the constant need to carry debt and continually pay interest on it, the producing economy is suffering from a severe scarcity of money. And it’s working under a system where the only way to get more money into the economy is to borrow it.

So we have a vicious circle where the necessity to pay the existing debt plus interest creates a scarcity of money, and the only way to relieve the scarcity is to borrow more money, which aggravates the scarcity, which is only relieved by borrowing more money…

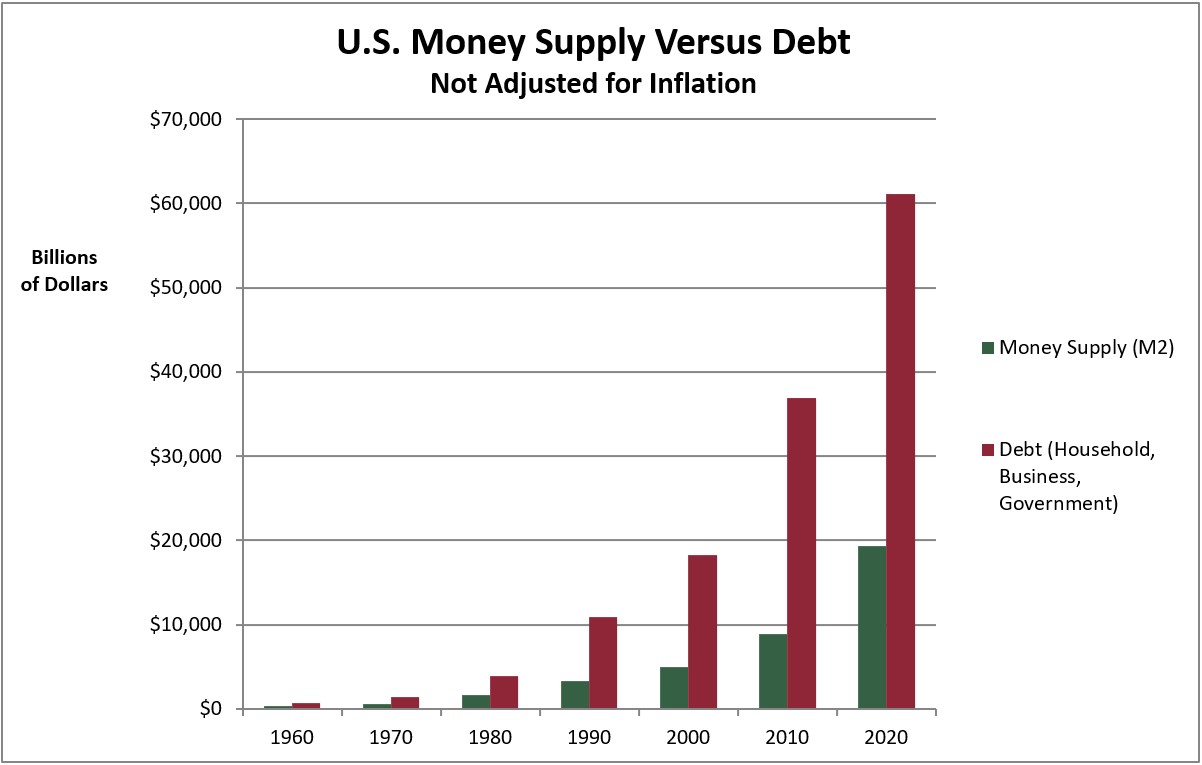

In this way, the economy has accumulated much more debt than money (graph). Essentially it’s operating like a pyramid scheme.

What’s a pyramid scheme?

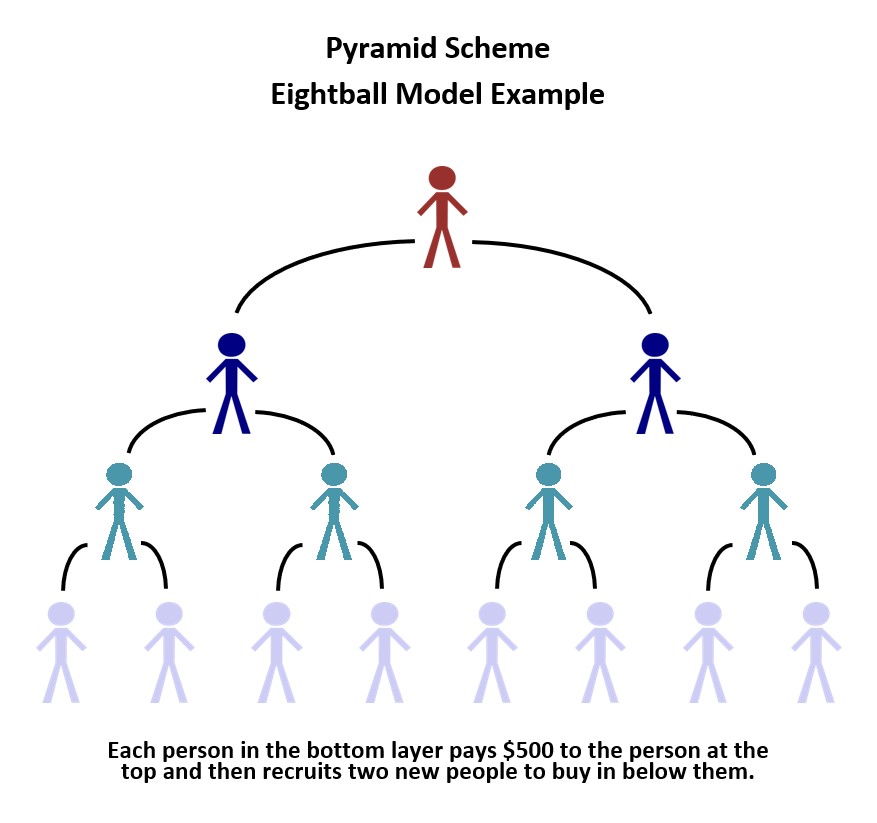

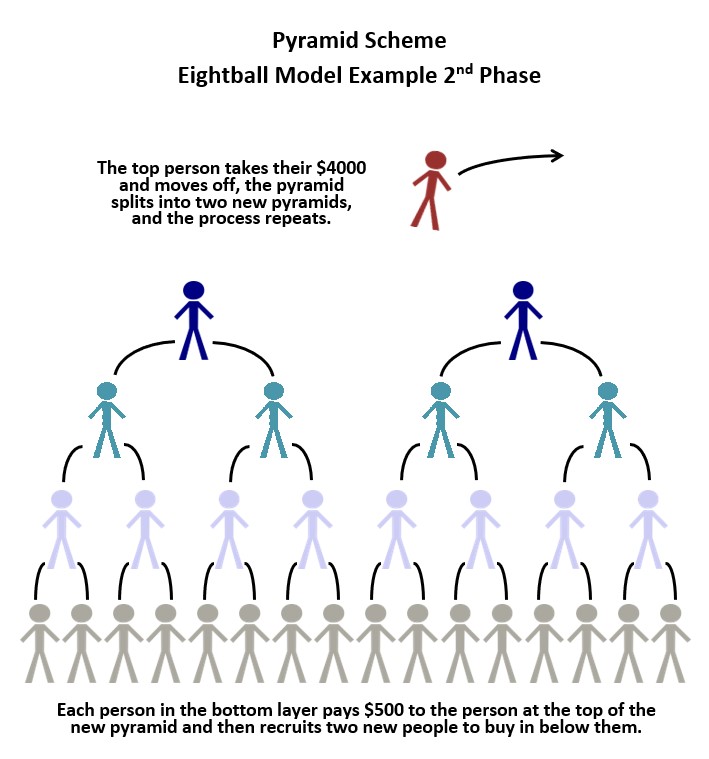

A pyramid scheme is a fraudulent “investment” scheme based on an expanding pyramid structure. In a pyramid scheme, you pay to enter the pyramid at the bottom and then recruit others to also pay in and enter the level below you. Those people likewise recruit others to enter the pyramid below them. As this process continues, you move up the levels of the pyramid, and if you reach the top, then the next level that buys in pays you, and you have your return on your “investment.”

If the pyramid grows according to the plan, the number of people buying in doubles every time a new layer is added. This is called exponential growth—it’s multiplying itself. This type of growth reaches very high numbers very quickly. The number of people needed to keep the pyramid going will soon exceed the number of people in the town or city, and well before that, it will exceed the number of people who can be persuaded to buy in. (see Exponential Growth below)

A key element of a pyramid scheme is that money flows in only one direction, from the bottom to the top. It’s based on an illogical unsustainable process, dependent on endless growth, and inevitably beneficial to only a few and detrimental to many. In all of these respects, it has everything in common with our debt-created money system and the general economic principles operating in today’s world.

A pyramid scheme always and inevitably breaks down and falls apart, leaving a few people who made money and a much larger number of people who lost money. Pyramid schemes are illegal in many places.

The debt-money economy has to grow to stay alive. The more it grows, the more and faster it has to grow, and the more unstable it becomes. The graph below shows the decade by decade progress of this phenomenon since 1960.

Notice that in 1960 debt was just a little more than twice the supply of money, and by 2010, it’s about four times as much. The graph below shows the same figures only without the adjustment for inflation, which gives a slightly clearer picture of what’s happening mathematically.

Following the tops of the debt bars you can see the steepening curve. If you’re familiar with the concept of exponential growth, you may recognize what’s often called a hockey stick curve.

Exponential growth, for those not familiar, is when something grows by multiplying itself. If a quantity grows by a percentage, eventually it will double. If it continues to grow by the same percentage, it will double again in the same period of time.

Economic Instability

As you can see, the structure of our money system is not stable or sustainable. By its core principles, it is destined to break down. The constantly growing debt that’s required by the system eventually becomes overpowering, curtailing additional borrowing and cutting off the growth that’s vital to the pyramid-scheme structure.

Additionally, the need for constant expansion is focused purely on money and consequently overshadows other needs and considerations such as: fairness to workers, prudent use of environmental resources, sustainable non-destructive business practices, and sustainable non-destructive societal values.

When money itself is created by bank lending and destroyed by debt repayment, the whole economy is left at the mercy of the arbitrary decisions of bankers and borrowers. Rather than the money supply being adjusted to respond to economic stresses in a rational way, it is controlled by random forces completely unrelated to the overall health of the economy.

In fact, bank lending decisions tend to be the exact opposite of what could benefit the overall economy. During times of prosperity, the banks try to lend as much as possible, creating borrower incentives and aggressive marketing programs to take advantage of the strong profit potential. This can inflate the prosperity into something more like a speculative bubble. When times are bad and people are suffering, banks get nervous about risks and losses and cut back on lending, thus tightening the supply of money and worsening the situation. Likewise, in a stressed or contracting economy, potential borrowers are understandably wary of taking on additional debt.

US Treasury and Federal Reserve officials have taken some pride in the fact that the aftermath of the financial crash of 2008 could have been, but wasn’t, just as bad as the Great Depression. What it took to accomplish that was multi-trillion-dollar deficit spending by the federal government, absent prosecution and correction of the clearly culpable (based on the too-big-to-fail hypothesis), and arcane monetary manipulations by the Federal Reserve that pumped up the investment sector and provided negligible help for the working economy. As shown in Why the Wealth Gap Keeps Getting Worse, only the wealthiest households ever recovered from the ’08 crash. Other levels of the economic hierarchy suffered permanent losses.

Environmental Destruction

In the context of our debt-based, growth-dependent economy, it makes sense to travel 10,000 miles to the other side of the planet and set up operations to produce something that could have been produced at home, and then burn fossil fuels shipping it 10,000 miles back to where you can market it to people who already have more than enough of it, so they can throw away what they already have and buy more.

Humanity’s Ecological Footprint has increased by about 173% since 1950, and we’re now exceeding the planet’s capacity to sustain us by about 56%.1 This means we would need more than one and a half Earths to sustain us in the way we’re currently living—that’s with the existing level of consumption in the developed nations as well as the existing levels of poverty and deprivation in the global south. One and a half planets. And it turns out there is no extra half planet, we just have this one. Plus there is no reasonable justification for allowing the existing level of global injustice to continue.

The underlying factor that needs to be noticed about our impact on the planet, is that we are locked into an economic system that mandates growth. Constant economic growth means ever-increasing production and consumption. We use more and more energy and more and more resources to produce more and more things that we don’t really need–because we have to do this to keep the economy going.

In the context of our debt-based, growth-dependent economy, it makes sense to travel 10,000 miles to the other side of the planet and set up operations to produce something that could have been produced at home, and then burn fossil fuels shipping it 10,000 miles back to where you can market it to people who already have more than enough of it, so they can throw away what they have and buy more.

Governments and economists throughout the world, target their national economies for 2-3% growth (or upwards of 5-6% if they’re China). This is exponential growth. And they’re deliberately aiming for it, year after year. Growth is promoted as the solution to poverty, inequality, and numerous other problems. “A rising tide lifts all boats,” is the saying.

But we live on a finite planet. And as you can see in Why the Wealth Gap Keeps Getting Worse, rising economic tides have not been lifting all boats. In fact in the longer term, the opposite has been true.

There are many factors involved in human impact on this planet. But to operate under a world-wide economic system that is structured to demand endless growth, is to doom ourselves before we begin.

Humans have the capacity to behave more intelligently than this. We could think of better ways. Many people already have.

See Also

- How the Banking System Works

- How Banks Create Money

- How the Debt-Based Money System Works (and doesn’t work)

References:

World Wildlife Fund, Living Planet Report 2020. pg 56: https://www.wwf.org.uk/sites/default/files/2020-09/LPR20_Full_report.pdf

Last updated: April 26, 2023

Photo credits: Market Crash iStock.com/peshkov; Landfill iStock.com/Kyryl Gorlov; Mouse 123RF Emielcia