In the article How Banks Create Money, we looked at how money is created by bank lending and how the system requires that lots of people be in debt all the time. Besides the social issues associated with that, there are some mathematical and logistical issues.

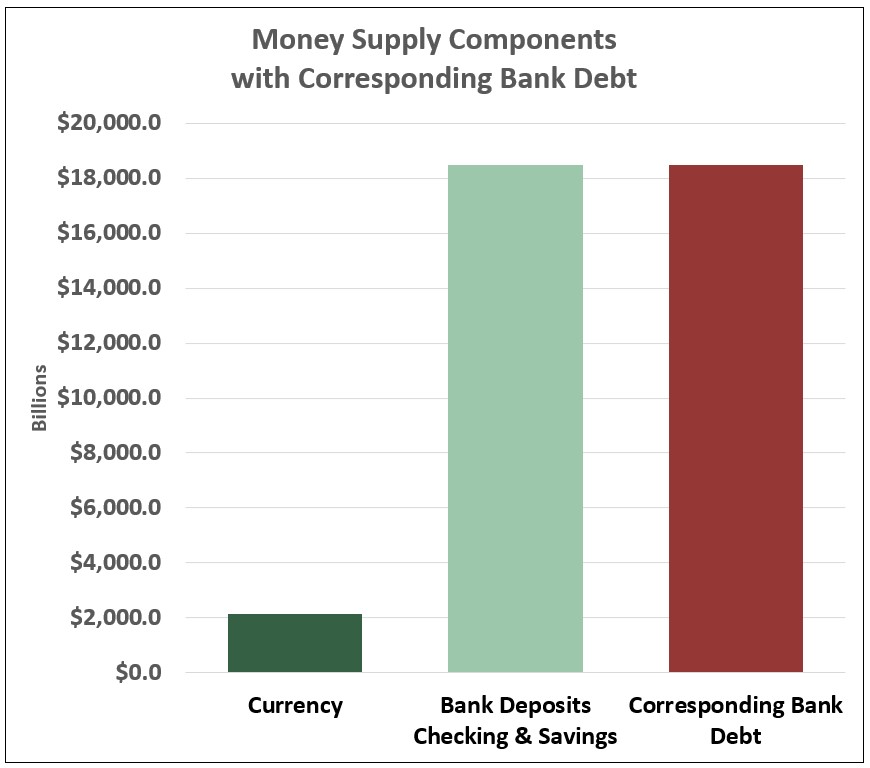

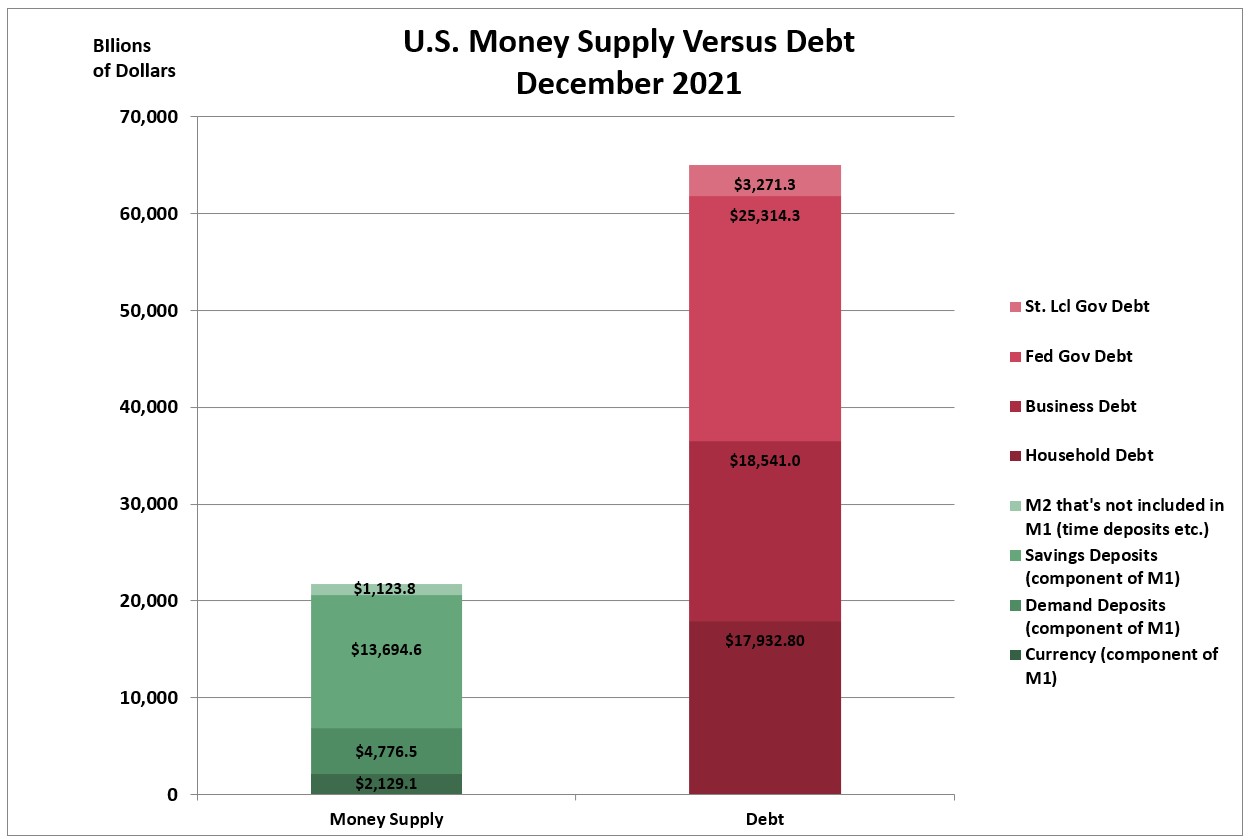

If we graph the components of the US money supply as reported by the US Federal Reserve Bank in their H6 Money Stock Measures report,1 and add a debt column equal to the bank-account money components, we get this:

“Banks can create new money because bank deposits are just IOUs of the bank”

Money in the modern economy: an introduction, Bank of England Quarterly Bulletin, 2014 Q1

The Money Stock report shows over $18 trillion in bank-account money, and just over $2 trillion in currency. Since the bank account money was created by bank lending, we can project an equal amount of bank debt.

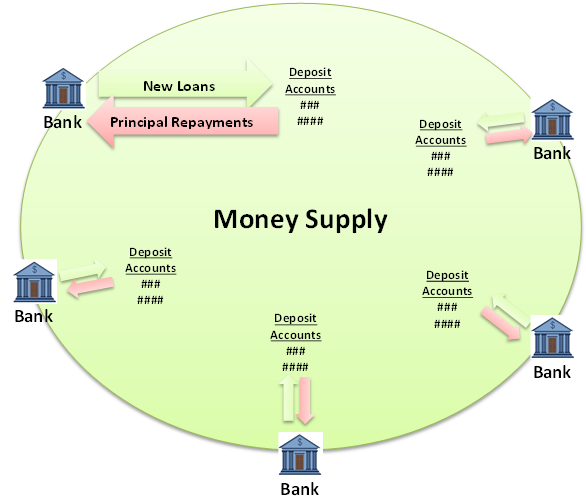

The bank-account money is being used to pay salaries, buy groceries, pay rent etc., and as long as it’s used for goods and services, it keeps circulating in the economy and paying for many different things. However, all the borrowers whose loans have been used to create that money have made agreements to pay the money back, and as soon as they do that, the money is gone from the supply.

When a bank makes a loan it gets a promissory note from the borrower, which is essentially the borrower’s IOU promising to pay the money back to the bank. In exchange the bank creates the bank account entry that the borrower can use as money—this is the bank’s IOU. Thus when the money is paid back, the IOU’s on both sides are extinguished—money is no longer owed.

Whenever a borrower repays loan principal to a bank, that money disappears from the overall money supply. The money supply increases when banks make loans and decreases when borrowers pay principal back to the banks.

“Banks making loans and consumers repaying them are the most significant ways in which bank deposits are created and destroyed in the modern economy.”

Money Creation in the Modern Economy Bank of England Quarterly Bulletin 2014 Q1

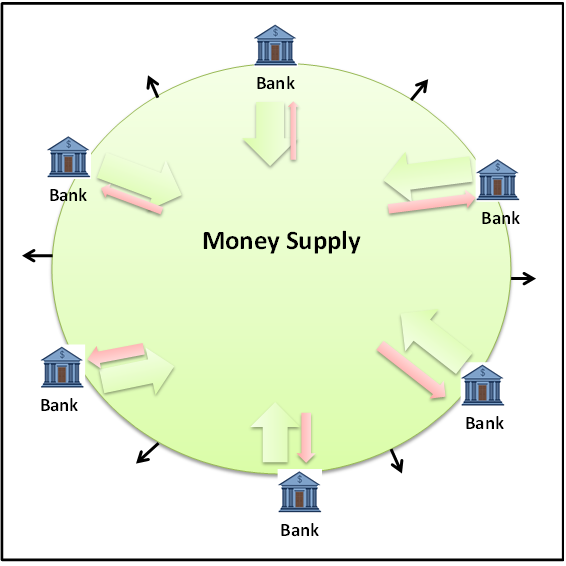

So if the economy is chugging along happily on a 20 trillion dollar money supply, all that has to happen to strangle it is for people to stop borrowing and start paying down debt, or for banks to stop lending. The supply of money is completely at the mercy of the bank lending system. Like this:

Plus all that debt has to be paid back to the banks with interest. What this amounts to is that home owners paying on their mortgages, graduates paying on their student loans, and all the other borrowers are essentially paying the banks to keep the economy supplied with money. The borrowers are saddled with constantly paying rent to the banks for the money supply that serves the whole economy.

You could stop right there and figure out that this is not the best way to create money for an economy, but there are additional problems.

Other Lending

In our theoretical comparison of debt and money so far, we’ve been considering only bank debt, but there are other entities that lend money. Banks are the only ones who can create money when they lend, so any other lending must be done with money that was already created by a bank.

Also there are many types of investments that work like non-bank loans. Bonds and what’s called commercial paper are examples. In this type of investment, the investor buys an agreement (a security) from the issuing company or entity. The agreement states that the purchase price plus interest/profit will be paid back to the investor within the specified time and conditions. Basically the investor is lending money at interest to that company or entity.

Once the debt-investor economy gets its hands on debt-created money, the money becomes twice-lent but only once created, and overall debt becomes greater than money.

Selling Loans

The selling of loans by banks is another practice that feeds this phenomenon. If you’ve taken a mortgage loan from a bank, you may have received a notice a few months later saying that some other institution had taken over your loan and you would now be sending your payments to a different address. What’s happened is that the bank has sold your loan as an investment asset.

In the US we have three government sponsored institutions involved in this, Fannie Mae, Freddie Mac, and Ginnie Mae. They buy multiple loans from banks and package them into investment securities that are then sold to investors in the Secondary Market.

Secondary Market refers to the fact that something is being resold after it was originally created and sold. The bank has essentially purchased a financial asset from you—your promissory note agreeing to pay back loan principal plus interest over time. Now they are reselling it to an institution that uses it to create debt securities that are then sold to investors and can be resold multiple times like stocks in the stock market. You won’t be affected by the reselling because part of the packaging includes a loan servicing company that will hold onto the job of collecting your payments and distributing the money to the investors.

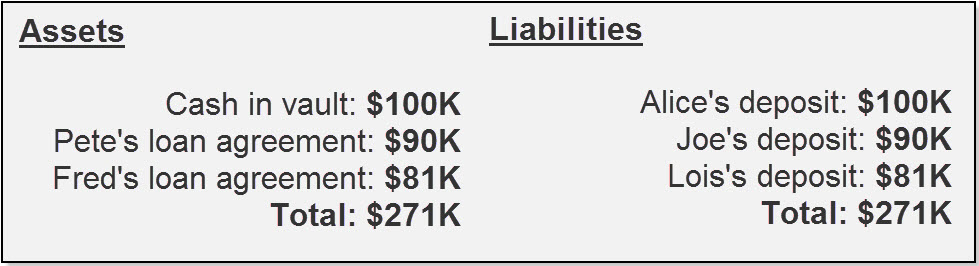

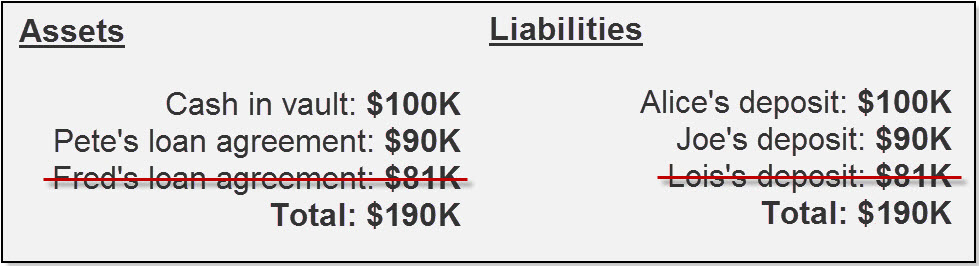

Going back to our scenario from How Banks Create Money, let’s suppose we start with this little balance sheet section for our theoretical bank:

If Fred’s loan is sold, that asset will be wiped off the bank’s balance sheet, and somewhere in the banking system, a deposit account balance will be reduced by the amount of the loan purchase price. To simplify it to fit in our single-bank example, we could cut out the middleman doing the packaging into securities and say Lois is an investor buying Fred’s loan for the $81,000 she has in her account. Below is what would happen to that section of the bank’s balance sheet.

The sale of the loan wipes both the asset and the liability off the bank’s balance sheet—they’re still balanced, and they’ve cleared the way for making more loans. The money in Lois’s account has been un-created just as if she had used it to pay off the loan principal on Fred’s behalf. And the loan agreement has been taken off the Asset side of the bank’s balance sheet.

However…the $81,000 debt wasn’t un-created, it’s just moved out of the bank’s hands and into Lois’s hands. Fred is still $81,000 in debt. If the buyer of the loan (or technically of the debt security) is not a bank that can use its money-creation power to make the purchase, this has the same effect as money lending by non-bank entities. The debt multiplies while the money stays the same.

Basically the situation we’re in is that we can’t create money without creating debt, but we can create debt without creating money. That’s how we got here:

Clearly the producing economy doesn’t have a prayer of getting out of debt. What it does is try to avoid default. It does that by paying the interest, paying enough principal to keep from going delinquent, and…by borrowing more money.

Thus debt in our economy is perpetual, and the constant drain of money and resources from the producing economy to the financial sector is also perpetual. The system is fueling massive injustice and inequality and having disastrous effects on economic stability and human environmental impact. See The Fairy Tale of Endless Growth and Why the Wealth Gap Keeps Getting Worse

See also:

References & Notes

- Money Creation in the Modern Economy Bank of England Quarterly Bulletin 2014 Q1

- Money in the Modern Economy, an Introduction Bank of England Quarterly Bulletin 2014 Q1

- Money and debt figures are taken from: U.S. Federal Reserve Statistical Release H.6, Money Stock Measures and U.S. Federal Reserve Statistical Release Z1, Section D.3. Credit Market Debt Outstanding

- The federal debt statistic shown does not include debt held by internal government agencies such as the trust funds for Social Security and Medicare.

- The money figures in the Money Supply Vs Debt graph come from reports generated by the US Federal Reserve Bank. (Money Stock Measures – H.6). Currently the Fed breaks down their money supply report into M1 and M2, which are categories based on how easily spendable the money is—referred to as liquidity.

- M1, the most spendable, includes cash and money in checking accounts and other similar accounts (referred to as demand deposits), and it includes money in savings accounts that don’t have restrictions on the frequency of withdrawals.

- M2 includes all of M1 plus Time Deposits and Retail Money Market Funds, which have restrictions on withdrawals. The breakdown in the graph shows the three components of M1–Currency, Demand Deposits, and Other Liquid Deposits (Savings)–plus the part of M2 that isn’t included in M1.

Last updated: April 26, 2023